You don’t really know what your insurance policy will do for you until you actually suffer loss or damage.

When this happens, you need your insurer to help you. Although you as the insured are not aware of this, more often than not you’re not actually contacting your insurance company to notify your claim. You’re contacting the organization that deals with claims on behalf of your insurer. HealthcareITexpertsis one of these organizations and we’re quite competent in it.

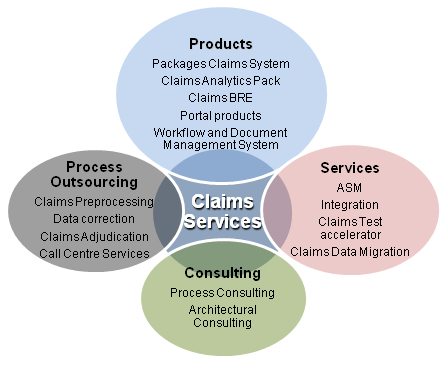

Claims management is a collective term for all work that HealthcareITexperts carries out for people or companies that suffer damage, as well as for the insurance provider. What does this work involve?

- Registering notice of claim (by telephone, e-mail, post or online), which automatically opens the client file.

- Checking the cover: is the damage insured and up to what amount?Asking for documents such as police reports of road accidents, medical reports in case of injury, invoices, etc.

- Determining which party is liable for the damage if another party is involved.

- Determining the amount of the claim and engaging a loss adjuster if necessary.

- Arranging for the damage to be repaired or for transport back home if the damage occurs abroad.

- Paying the claim to the insured party.

- Initiate subrogation process to recover loss from a responsible third party, if applicable.

- Reporting to our client (the insurance provider), including management information, showing e.g. the progress of all their claims files and the total amounts to be reserved and paid.

- Fraud prevention checks.

We Provide the Software of claims all over world every year!

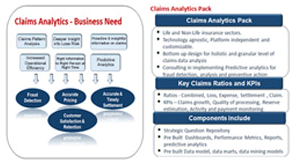

Payoff from investing in our claims management solution comes from reduced expenditure on report generation and empowerment of analysts and quicker response to market trends.

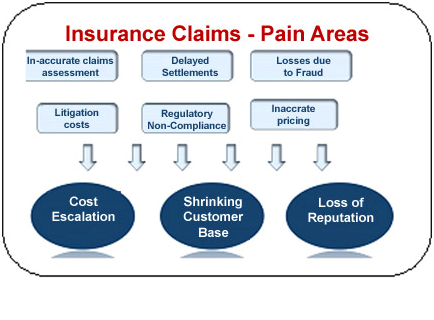

The current analysis within most insurance companies is limited to information available in static operational reports – no slicing, dicing, pattern analysis, fraud analysis. However, there is now increased focus on collecting, storing, managing, and analyzing their data effectively.

- Wide range of Reports, Metrics and dashboards – Easily identify your reporting / analytics needs

- Prebuilt extensible Data Models and Marts – Fast track your insurance warehouse initiative

- Key ratios (Combined, Loss, Expense, Settlement, Claim) to control costs and reserving accuracy

- Analysis Product, Region, Channel – Deep insight for improving operational efficiency, customer satisfaction and retention, process effectiveness and cycle time

- In-house accelerators & frameworks Save 25% cost / effort to build Insurance analytics solution

Super strona